FAQ's

Our principal, Eoin O’Shea is a qualified solicitor with a Bachelor of Civil Law Degree from University College Dublin and a Diploma in Trusts, Taxes and Estate Planning, regulated by the Law Society and fully insured, with 30 years experience in probate law. He is also a member of the Society of Trusts and Estate Planning (STEP) an internationally recognised organisation of experts in the field.

We appreciate that having suffered a bereavement, you may be anxious to have the affairs of a relative or friend dealt with professionally and cost effectively. We appreciate that the language used can be confusing so we speak in plain English.

We can help you if you are:

- An Executor of a Will;

- A relative of a person who died with no Will;

- A beneficiary who needs advice;

- A person involved with a dispute.

Our aim is to provide you with a tailor made service to suit your requirements and your budget, and to relieve you of the worry and stress involved in the process. You can relax in the knowledge that your business will be handled by an expert, in total confidence and in a friendly and compassionate manner.

A Grant of Probate is the legal document that entitles an Executor or Administrator to deal with the assets of a deceased person. It issues from the Probate Office and proves to all that a Will is registered with the High Court. It entitles the Executor of a Will or the Administrator to take charge of the property and bank accounts of the deceased person and if needed, transfer them into his or her own name or the name of a beneficiary or next of kin. Where there is no will the document is called a Grant of Administration. It is required for all estates that include property and all estates exceeding 20k in value.

If you are the Executor appointed in the will of the deceased person, you have to apply for the Grant of Probate upon which your name will appear, proving to all persons reading the Grant that you and only you are entitled to take control of the assets of the deceased including the bank accounts, property and other investments. Upon production of the Grant to the Bank or other financial institution, they are obliged to release the funds to you. If you wish to transfer property then you will only be entitled to do so upon production of the Grant. Whether a grant of probate or letters of administration are required depends upon the value of the Deceased’s persons assets.

If the deceased’s persons estate is over 20k in value then a grant of probate or a grant of letters of administration (if no will exists) will need to be obtained from the probate registry. There are lots of other reasons why a grant may also be required, for example :-

- Property cannot be sold or title transferred to a beneficiary without a grant.

- Shares cannot be sold without a grant.

- Funds in a bank account of the deceased will not be released without a Grant

- The deceased may have business interests that require a grant.

- A grant of probate maybe be beneficial for reducing inheritance tax in the future.

- Property if held by the deceased person as a tenant in common cannot be sold without a grant.

If you are in any doubt as to whether a grant of probate is required please call our free probate helpline on and we will be pleased to advise you.

An Executer is the person named in the Will of a deceased person to carry out the wishes of the deceased. The Executor is the only person entitled to apply to the Probate Office for a Grant. He or she will gather in the assets, pay off the debts and funeral expenses and distribute the estate in accordance with the wishes of the deceased as expressed in the Will.

We appreciate that being the executor or administrator carries with it responsibilities and worries and can be a burdensome task. It also carries personal liability if the job is not done in accordance with the law. We provide a friendly and compassionate service for people who are dealing with a bereavment. As we are qualified in the business for 30 years, we have developed an expertise in this area which means we remove all the hassle and worry so you can achieve the result you need quickly and efficiently and at a price level that will suit your budget. We can also look after the Revenue Returns, Income Tax, Inheritance Tax, payment of Bills, Sale of Property, Share Sales, encashment of Life Policies, Post Office Savings Certificates and Bonds. We can also advise if there are ways to minimise the tax liability after death.

A beneficiary is anybody who is entitled to receive a benefit from a Will or in the absence of a Will, under the rules of the Succession Act 1965.

A person who dies without having made a will is said to have died ‘Intestate’. Where there is no Will, then the Succession Act 1965 sets out who is entitled to a share in the estate. An Administrator will apply to the Probate Office for a Grant of Administration Intestate and, having paid off the debts and funeral expenses, will then divide the net estate among the next of kin of the deceased.

Absolutely not. Many legal firms do charge a percentage of the value of the estate. Oshea Legal are offering very competitive flat rates for this service. We also give you the option to undertake some of the time consuming work yourself so that you can save even more money! Why not contact us for a quote? No need to divulge any personal details and you will not be harassed or spammed. All our

dealings with you are governed by the Law Society approved ‘Code of Conduct’

Where there is no Will, then the Succession Act 1965 sets out who is entitled to a share in the estate. An Administrator, usually the next of kin, will apply to the Probate Office for a Grant of Administration Intestate and, having paid off the debts and funeral expenses will then divide the net estate among the next of kin of the deceased.

If you decide to do it yourself, the process can take anywhere from seven months up to eighteen months depending on what sort of assets are in the estate. We at O’Shea Legal can get a Grant issued as quickly as three months from the date you deliver us full instructions. However each case will be different. We promise however to get you your Grant as quickly as possible as it the duty of an Executor to act efficiently in the administration of an estate. The beneficiaries will not appreciate having to wait around for their money!

Inhertiance Tax is the main tax that may apply. If the beneficiaries get more than their tax free threshold then they will have to pay tax at 25% of the value of the amount they inherit that exceeds that threshold. The following are the tax free thresholds currently applicable (to deaths since 7 December 2011):

|

A |

Son/Daughter |

|

|

|

€250,000.00 |

|

B |

Parent/Brother/Sister/Niece/ Nephew/ Grandchild |

|

|

|

€33,500.00 |

|

C |

Relationship other than Group A or Group B |

|

|

|

€16,750.00 |

Please feel free to contact us if you have any queries.

Other Taxes that may arise are Gift Tax, Stamp Duty, Income Tax and Capital Gains Tax. On the 2nd of March 2009 the Revenue published a very helpful guide to Capital Gains Tax and this is available from their website under the “news” section.

Capital Gains Tax is a tax on any gains made on a disposal of an asset. If you acquire something for €100.00 but dispose it for €200.00, then you have made €100.00 and tax is payable on that gain. The current tax rate is 30%.

Stamp Duty, is a duty which is paid by a purchaser of property, or by a beneficiary when the beneficiary receives a gift of the property. The rates of duty are as follow:

Residential Property - 1% of the value of the property.

Non-Residential Property – 2% of the value of the property.

Where there is a Will, only the appointed Executor can apply.

Where there is no will then the persons entitled to a share in the estate ie Next of Kin can apply. The next of kin are defined in the Succession Act as follows;

- Surviving Spouse;

- Child or other descendant;

- Father or Mother or;

- Nephew or Niece;

- Grandparent;

- Uncle or Aunt;

- Great Grandparent;

- First Cousin, great-uncle or great-aunt, grand nephew or grand niece;

- Great great grandparent;

- Other next of kin depending on degrees of blood;

- In certain circumstances some classes of non blood related persons may apply.

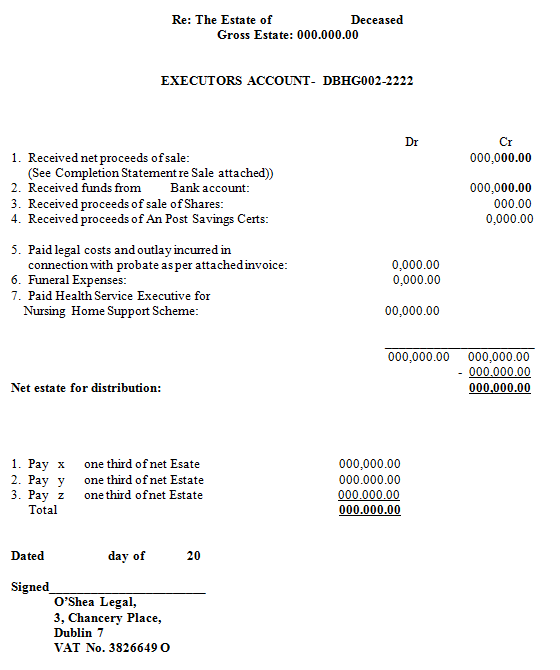

Approximately 90% of applications are made through a Solicitor. The process can often be complex, requiring the completion of Probate forms, Revenue returns and and Executor’s Accounts. There are also certain onerous legal obligations imposed on an Executor or Administrator. You do not need a solicitor if you have time on your hands and you are a person who is able to deal with paperwork, bank accounts, revenue commissioners, and are competent when dealing with figures. You can apply directly to the personal applicants section of the Probate Office and they will provide you with assistance in applying for a Grant. Currently the waiting time for an appointment is approximately seven months. You will however be assuming duties and responsibilities with which you may not be familiar.

Not everyone has the time or the inclination to undertake this task themselves and prefer to hand over the responsibility to a professional. This has the advantage of ensuring the work is done quickly, avoiding the lengthy delays for personal applicants in the Probate office, and that you get the benefit of advice to protect you against personal risks in acting as executor or administrator. The following are some of the reasons most people opt to use an experienced solicitor:

- Speed of obtaining the Grant - it can be generally be quicker using a Solicitor as no interview at the Probate Registry is required when a Solicitor is used;

- Property of a Deceased - if the Deceased estate includes a property a Solicitor will need to be instructed at some stage and therefore using a Solicitor for the probate can assist in the sale of a Deceased person's property;

- No Will - if the Deceased dies without a Will, having a Solicitor to advise on the Intestacy rules can be sensible;

- Inheritance Tax - if the Deceased estate involves Inheritance Tax issues, a Solicitor may well help reduce the Inheritance tax e.g. through a Deed of Family Arrangement or Deed of Disclaimer;

- Contested Probate -if the will is in dispute, having a Solicitor to advise upon procedure is often very important;

- Fully insured - a Solicitor carries professional indemnity insurance for all work undertaken, which does help alleviate individual concerns an Executor may have when undertaking probate personally;

- Disgruntled beneficiaries – Dealing with the estate of a deceased can be very emotive and the Solicitor can act as a buffer between the family members to keep the peace.

If there are income tax returns to be filed you may need an accountant. The Revenue Return CA24 required in all probate cases and the Inheritance Tax returns (if required) can be done without an accountant.

The issue of a Grant from the Probate office is a matter of public record and may be published even without your consent.

You may do this by handing over all responsibility for to us and we will be glad to be of service to you. Simply click the Contact Us button at the top of this page or call us on our free helpline or by email.

If it was proved that a Will was made in favour of a particular person by duress, coercion or undue influence, a Court can strike down that Will. If you are a child of a deceased and you have bee left out of the Will then a Court can alter the terms to make proper provision for you. If you are a widow who has been left with inadequate provision you may prefer to take your ‘legal right share’ as is your entitlement under the Succession Act 1965. Feel free to contact us at our freecall helpline if you have any concerns and would like some advice.

If there is no Will, then the Next of Kin will inherit the estate of the deceased.

If a married person dies with no children, the spouse inherits the estate. If a married person dies with children, then two thirds go to the surviving spouse and one third goes to the children.

If a person dies unmarried or with no widow or children surviving, then the estate will pass to the parents, but if both parents are deceased, then the estate will pass to the deceased’s brothers and sisters.

The term ‘Personal Representative’ applies to the Executor and to the Administrator. They apply to the Probate Office for the Grant which gives them the legal authority to collect the estate of the Deceased, pay off the debts and funeral expenses, and distribute the assets.

If a person dies leaving assets which were held by him/her as joint owner with another person who is alive, those assets usually become the sole property of the survivor on the date of death. In the case of a Bank account, the bank may require Revenue clearance before releasing the funds to the joint account holder however a Grant will not be required in most cases. In the case of property, the production of a death cert will suffice to change the register of ownership into the name of the surviving joint owner. If however the property is not owned ‘jointly’ but rather as ‘tenants in common’ then a Grant will be required as it does not pass to the other owner bur becomes part of the estate of the deceased person.

The following is an extract form the Probate Office website;

Probate Offices.

|

The Probate Office. The Probate Office deals only with what is termed the 'non-contentious' probate jurisdiction of the High Court. The main functions of the office are: The admission of wills to proof. The issuing of grants of probate and administration. The preservation of probate records for inspection and the provision of certified copies of probate documents. The processing of court applications to the probate judge. |

Related Links: |

Role of the Probate Officer and Assistant Probate Officer.

The Probate Officer and Assistant Probate Officer have the power to;

- Prove and condemn wills

- Issue Grants of Probate and Administration

- Issue citations and subpoenas

- Make Orders and Rulings pursuant to the Rules of the Superior Court 1986.

Decisions and orders of the Probate Officer, Assistant Probate Officer or Deputy Probate Officer can be set aside only by order of the court.

The Probate Office comprises four public offices.

The General Office:

Responsible for maintaining records of all grants of representation which have issued and for providing copies of probate documents. Requests received by post for copies of probate documents. Contact the general office at probategeneraloffice@courts.ie

The Seat Office:

Assessing applications for grants of probate or administration lodged by solicitors and their agents. Solicitors may contact the Seat Office in regard to probate applications at ProbateSeatOffice@courts.ie

The Rules Office:

Responsible for searching records to ensure that there is no impediment to the issuing of grant of representation. Filing and issuing of citations, caveats, subpoenas, court motions and Probate Office motions. Issuing of court orders from the Probate Court list, Probate Officer's orders and Side Bar orders made pursuant to the Rules of Court.

The Probate Personal Applicants Section:

Applicants for grants of probate or administration may apply personally through the Personal Applicants section of the office which operates pursuant to order 79 rule 74 to 80 of the Rules of the Superior Courts. Enquiries in regard to personal applications may be made by email to probatepersonalapplications@courts.ie.

|

District Probate Registries. In addition to the Probate Office there are fourteen District Probate Registries located outside Dublin. These registries are attached to Circuit Court Offices under the control of County Registrars. They have authority to issue grants of representation where the deceased, at the time of his/her death, had a fixed place of abode within the area of jurisdiction of the District Registry. For example, if the person died having a place of abode in Co. Clare, the application for a grant of probate may be made to the District Probate Registry at Limerick. The application may be made in person or through a solicitor. |

Related Links: |

So why not get a no obligation fixed fee quote now. You could save a lot of money. If you have questions, why not call or email us now without obligation and we will be happy to answer your queries without charge.

Disclaimer

No solicitor/client relationship or duty of care or liability of any nature shall exist or be deemed to exist between O’Shea Legal and you until you have received confirmation in writing from us in which we confirm our appointment as your Solicitors.

*In contentious business a solicitor may not calculate fees or other charges as a percentage or proportion of any award or settlement.

Enquiry form

Our testimonials

All original testimonials on view at reception

-

Many thanks for your Kindness.PH Wexford

-

As we celebrate this Holy Season, I wish to express my deep gratitude to you and all who help us keep this lifeline for the homeless in operation.Bro. Kevin Crowley

-

Eoin, you're more than welcome for the gift. Apart from all the legal matters you dealt with, I really appreciated your patience and understanding.SO'S. Dublin.

-

Many thanks for all your help over the past three years with grateful appreciation.MD Dublin

-

I have engaged Eoin O’Shea as my solicitor on several occasions over the years and I am more than happy with his services. I wish Eoin continued success in his legal practice.M. Lyons, Dublin.

-

To Eoin, Thanks for everything: for a smooth, efficient and painless process! All the best.B, Terenure, Dublin.

-

I want to thank you so much for all your help on the case. You’ve been brilliant. I wish I had known you before I made all the mistakes. You are a wonderful solicitor…..C.C. Dublin

-

Just a note to say thank you so much for your kindness and understanding. You made such a difference at a very difficult time in life. Heartfelt thanks to you Eoin.LB, Dublin

Our Legal Publications

Shopping cart under construction.

The Executors Guide - 'At last a step by step guide, composed in plain english, for the executor or administrator who chooses not to employ a solicitor. This book contains invaluable advice and tips on how to get the difficult task of winding up an estate of a deceased person done as quickly as possible avoiding the traps for the unwary. It covers all the steps from the grave to the final distribution of the estate. It can save the estate thousands of euro in legal fees'

The Executors Guide - 'At last a step by step guide, composed in plain english, for the executor or administrator who chooses not to employ a solicitor. This book contains invaluable advice and tips on how to get the difficult task of winding up an estate of a deceased person done as quickly as possible avoiding the traps for the unwary. It covers all the steps from the grave to the final distribution of the estate. It can save the estate thousands of euro in legal fees'

The Employers Guide - 'The only up to date guide on how to hire, manage and fire staff without fear of being sued.This book contains invaluable advice and tips for employers on how to negotiate the minefield that is employee rights and obligations. It contains precedent employment contracts incorporating the requirements of the latest Irish Law together with sample policy documents, procedures and letters for the most common situations. Written in plain English this book is required reading for every employer who prefers to preserve the company funds for the benefit of the company as opposed to its lawyers and unfairly treated employees.'

The Business Start-Up Guide - Essential reading for any budding entrepreneur wishing to establish a business in Ireland. This book describes in plain english the main rules and regulations that must be followed and gives invaluable advice and tips for the unwary. It covers advice on limited liability, partnerships and sole traders , employment traps for the unwary, health and safety obligations, standard documents and contracts. A must read for any businessman who wishes to avoid being prosecuted or sued.

The Accident Victim Guide - The ultimate guide to dealing with the consequences of an accident. This book, written in plain English, describes the steps that need to be taken after an accident to preserve the evidence, prepare a case, file a claim with the Injuries Board, quantify all the losses, value an injury and process a case through the courts. It gives lots of useful insider tips to help you deal with Solicitors, Doctors and Insurance Companies and even on how to process your own claim. This is an easy to read and invaluable guide.